The current system requires individuals to cover their social care costs if they have savings of over £23,250 or own their own home (this only applies if you’re moving into a care home). The cost of care varies depending on where you live, and there is no cap on care home fees.

According to the new social care cap, which is due to take effect in 2023, £86,000 will be the maximum amount anyone must spend on adult care costs during their lifetime. Once the £86,000 cap has been reached, local authorities will cover care costs funded through a new health and social care tax. The cap will only come into effect in England as Scotland, Wales, and Northern Ireland can set their health and social care policies.

However, whilst £86,000 may be a starting point that many people can factor into their financial futures, this amount does not include daily living expenses like accommodation, food, and bills. The communications director at retirement specialist Just, Stephen Lowe, has said that

“it could easily take perhaps three or four years and perhaps £200,000 to £400,000 of associated spending to reach the cap”.

How will it work?

The social care cap will be means-tested based on individual assets.

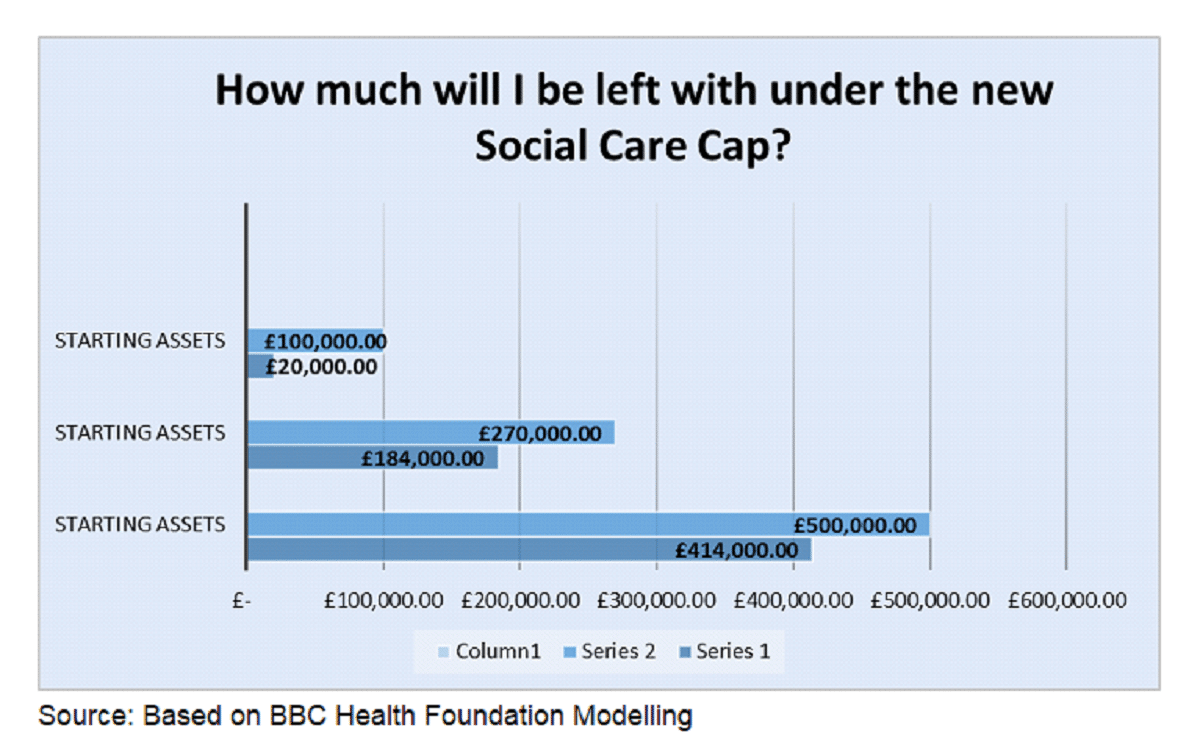

People with assets less than £20,000.00 will not have to pay anything towards their care. Those who have assets up to £100,000 will have to fund their social care costs up to £86,000. Once this amount is reached, their local authorities will take over. Anything that an individual’s local authority contributes financially will not count towards the £86,000 cap; this amount must be paid solely by the individual.

Is £86,000 the maximum amount you’ll pay for the cost of care?

No. The Department of Health and Social Care clarifies that daily living costs are excluded from the £86,000.00 cap. Individuals will have to pay for daily living expenses with a cap of £200 per week. Still, this money does not contribute to the social care cap of £86,000, which means if the cap has been reached, they will have to use their assets or income to pay for expenses such as accommodation, food, and bills.

Sir Andrew Dilnot, who was chair of the 2011 commission, Fairer Funding For All, told MP’s that he was “very uncomfortable” about excluding daily living costs from the social care cap. He has also said that “those with less valuable houses but facing significant care journeys will be much less protected against catastrophic risk and the sale of their house”. According to Dilnot, excluding daily living costs will result in people with assets totalling less than £100,000 losing 80% of them.

What are the practical implications?

“The average self-funder in a care home that costs £776 per week will have to pay the whole amount for more than four years before they get any help from the state.”

Currently, people with assets up to £23,250 qualify for financial assistance from their local authorities to help with the costs of adult social care. Under the new proposals, this threshold is raised to £100,000.

However, the proposals have been criticised for negatively impacting the less wealthy. The social care cap will require the less wealthy to use more of their assets to pay for their care than those who are wealthier. Using the current system, individuals with a wealth of £100,000 and £2000,000 would lose a maximum of 93% and 86% of their wealth, respectively. However, under the new proposals, individuals with £200,000 will lose considerably less of their wealth (43%), whereas those with £100,000 will still lose most of their wealth (80%).

The communication director at retirement specialist Just, Stephen Lowe, has said that “the average self-funder in a care home that costs £776 a week will have to pay the whole amount for more than four years before they get any help from the state…if they need care for six years, they will pay more than £200,000.”

Sir Andrew Dilnot has also argued that these new changes will create a north-south divide “because it will affect people with lower value assets and there are more people with lower value houses in the North than in the South”. The average house price is far higher in the South-East, at around £323,353.00 (March 2020), compared to the North-East of England, where house prices average £126,945.00 (March 2020). The charity Age UK has agreed with this idea, stating that “it becomes clear that the cap will disproportionately benefit those living in the South, rather than the North, where house prices are much lower, flying in the face of the Government’s ‘levelling up’ agenda.”

What do experts think about the changes?

“The changes to the social care cap is a regressive step that will leave people with low levels of wealth still exposed to very high care costs.”

During his first speech as prime minister, Boris Johnson vowed to “fix the crisis in social care once and for all.” In response to the government’s white paper on adult social care reform, Hugh Alderwick, head of policy at the Health Foundation, said that it “falls well short of what is needed to deliver the prime minister’s promise to ‘fix’ social care once and for all”.

Andrew Dilnot has warned that recent changes to the social care cap will diminish benefits for the less well-off. Dilnot has said, “it will mean those who are less well-off will hit the cap after much longer than those who are better off,” meaning that those who are less well-off will “end up having to spend…as much of their own money as people who are much better off”. Dilnot also told the Treasury Select Committee that “around 60% of older people who end up needing social care have assets less than £186,000 and about 30-40% less than £106,000”. The result of this, according to Dilnot, is that “people with significant care needs and assets of £106,000 will be hardest hit by the cap changes, but it will not make a difference to anyone with more than £186,000”.

The policy director at the King’s Fund health think tank, Sally Warren, said: “The changes to the social care cap is a regressive step that will leave people with low levels of wealth still exposed to very high care costs”. Warren continues by saying that “it is likely to mean that some people with moderate assets living in poorer areas will still be forced to sell their home to pay for their care, while wealthier people from richer parts of the country will be protected from this”.

Warren has also said that “they may well wonder why the Prime Minister’s promise that no one needs to sell their house to pay for care will benefit wealthier people but doesn’t seem to apply to them”.

How will this affect you?

“It could easily take perhaps three or four years and perhaps £200,000 to £400,000 of associated spending to reach the cap.”

The social care cap brings both positives and negatives with it. On the positive side, the cap has helped eliminate some of the uncertainty of future care costs, making financial futures easier to plan. Alastair Black, head of financial services company, abrdn, has commented on this. He has said that “there is no doubt this announcement is a good thing for advisers, and their clients as a clear commitment to tax funding will give them confidence for the first time that long-term care planning will become more straightforward”.

Black continues by saying that “most people don’t have £200,000-£3000,000 to put aside in their financial plan, which is how much care could cost if there was no cap…currently people can lose their entire wealth to social care…this means advisers are working with uncapped risk”.

Unfortunately, it is not all good news. There may be a starting point of £86,000 that many people can factor into their financial futures, but this amount does not include daily living expenses like accommodation, food, and bills. The communication director at retirement specialist Just, Stephen Lowe, has said that “it could easily take perhaps three or four years and perhaps £200,000 to £400,000 of associated spending to reach the cap”. Due to the social care cap, people’s financial futures are not fixed, and those who are less wealthy may have fewer assets left to pass on.

Planning for the future can feel daunting and overwhelming. That’s why at Brighton Wills you will be dealing with real people who have your best interests at the heart of our business. We maintain excellent standards through our membership of The Society of Will Writers, who administer the industry Code of Practice. Our professional, yet non-stuffy approach is a testament to the hundreds of satisfied clients who have chosen Brighton Wills to write over 1,500 wills and lasting power of attorney documents since 2014.